After BJT quoted Long Island, N.Y. businessman Michael Pascucci's claim that his flights on his three aircraft are 'free' based on the offset revenue he earns from their charter, we received feedback from readers questioning whether this is truly possible. (See Center Stage, October/November 2007, and Your Letters, December 2007/January 2008.-Ed.) Pascucci's accountant subsequently insisted that charter indeed covers all his costs-right down to the pretzels and peanuts-but we decided to talk to some industry experts to get their opinions. Is it really realistic for an aircraft owner to expect charter to offset all his expenses? Responses from those we interviewed ranged from highly skeptical to guardedly optimistic.

'We've certainly seen a lot of people try,' said Steve Hankin, CEO of Sentient Flight Group in Weymouth, Mass. Control print screen. 'There are more people who thought they'd be able to do it and didn't than people who have been successful at it.'

David Rimmer, executive vice president of Ronkonkoma, N.Y.-based airplane management company Excelaire, agreed. 'It's hard to achieve, and I think it's not a goal I would go into aircraft ownership with,' he said.

Others, including Cyrus Sigari, president of the recently formed very light jet management company Jetaviva, took a more positive slant. 'If the owner is flying 100 hours or less [per year] and the operator has good scheduling control and can utilize the asset, it's very possible for it to get close to breaking even or even making some money.'

Many expenses require evaluation before you can calculate whether you're flying for free or at greatly diminished cost, however. Along with the fixed and variable costs of operating the aircraft, you must account for acquisition costs as well as tax depreciation and any real depreciation. Tax depreciation in particular is 'a big part of the puzzle,' said Sigari.

But while tax situations and aircraft depreciation vary widely and play crucial roles in determining whether you can achieve zero-net-cost flying, our experts agreed that you must follow certain ground rules to even have a shot at covering your ownership costs with charter revenue. Here's what you must do:

1. Find the right management. 'Your revenue stream is only as good as the company that charters your aircraft,' said Kenneth Starnes, CEO of Woodstock, Ga.-based Cerulean Jet. If a company is aggressively marketing your aircraft to its clients, [covering all your costs] is certainly achievable.'

Rimmer agreed. 'You're depending on the business that your charter company has,' he said. 'You want to make sure that it has the demand to keep your airplane as busy as you want it to be.'

2. Say goodbye to easy access. To maximize charter revenue, you've got to make your aircraft available for customers as much as possible, which can be tough. New owners 'don't always want their shiny airplane to be in the hands of strangers,' said Rimmer. And the times when demand for charter is highest may also be the times when you most want to use the aircraft yourself. Considering how rarely the aircraft might be available to you, said Hankin, 'you have the question of, 'Are you better off just being a charter client yourself?'

Michael Leeds, president of the Long Island, N.Y.-based jet management company FlightStar, commented similarly. 'If you fly the plane 200 hours a year and keep it out of the charter market, you won't get nearly the economic value that you could if you fly 25 hours a year,' he said. Another factor is that your own use boosts costs; the less you fly the aircraft, the less charter income you need to break even.

Scheduling flexibility is crucial. 'It is impossible for you to demand the airplane for 20 days a month' and still come out ahead, Starnes said. 'The charter company needs to be able to get that aircraft when it needs it, and it needs to be available at least 75 percent of the time' to make profitability possible.

Some owners rely on flexibility in their own schedules to achieve greater availability. 'If you insist that you go home New Year's Day, you're cutting out a day when the charter outfit will probably have the ability to get even more business than usual at a higher rate,' Leeds explained. 'What I do all the time is say, 'OK, I'll go the day before or the day after or later in the day to accommodate customers.'

Some owners take the opposite strategy, setting out their usage needs months in advance, according to Bob Seidel, senior vice president and general manager of aircraft management and charter for Jet Aviation. 'Our best arrangements are what we call 'look and book.' The owner's flight schedule is clearly defined, and if the airplane is not down for maintenance and not flying for him, we can make it available for charter,' he said. 'We don't have to go back to the owner and ask for permission.'

3. Go where the action is. 'Does it help to be in a geographic area that's got a population with higher net worth? Absolutely!' said Jetaviva's Sigari, whose outfit is based at Van Nuys Airport in Los Angeles. 'There are quite a few affluent individuals around our area, which makes it a lot easier for us to generate revenue with our airplanes.'

Seidel agreed. 'An airplane is more likely to be chartered if it's where people who want to charter are located or want to go,' he said, adding, 'Say you have the best airplane in the world. If it's in Kansas and all the charter for it is on the coasts, then every time you chartered that airplane, you'd have to fly it to the coast before you even begin the charter and then at the end you'd have to fly it back to Kansas.'

4. Choose a profitable airplane. A lot of the potential profitability in a charter situation depends on the aircraft itself. With the recent spike in fuel costs, newer, more efficient aircraft have a decided advantage. 'For all aircraft, there comes a time when they become less efficient and less desirable,' Leeds said. For some older business jets that time has come.

Recalled Excelaire's Rimmer: 'We had a conversation just the other day with the owner of a [Gulfstream] GII who was surprised to hear that with the operating costs, he might actually lose money chartering out the airplane.' In addition to higher fuel costs, owners of older aircraft face a catch-22 situation: 'I think it's harder with older aircraft, because the more you fly them, the more they need maintenance,' said Hankin.

There is also a customer preference for newer aircraft. 'The newer the model, the better chance it has of being competitive out in the charter market,' Starnes said.

Another factor is how recognizable your aircraft is. 'The more you have to explain an airplane to people, the harder it is to charter,' said Rimmer. 'People like name brands. You don't have to explain a Gulfstream or Global Express.'

5. Sell the right flights. Once your aircraft is chartered, the type of flights for which it is selected can contribute to the bottom line. 'The most advantageous flights in terms of the maximum efficiency of the aircraft and thus the lowest operating costs are long-range trips where you burn all the fuel,' said Jet Aviation's Seidel. 'You're not tankering a lot of fuel at the end of the day from point A to point B and you're able to fly at very high altitudes.'

Owners should monitor how charter operators use their aircraft, Rimmer said. 'The reality is that every charter management company has to service its clients by doing both the better trips and the less productive trips,' he explained. 'You just want to keep an eye on how many of those good trips your airplane's getting and be realistic about whether good trips are a reasonable expectation in your airplane.'

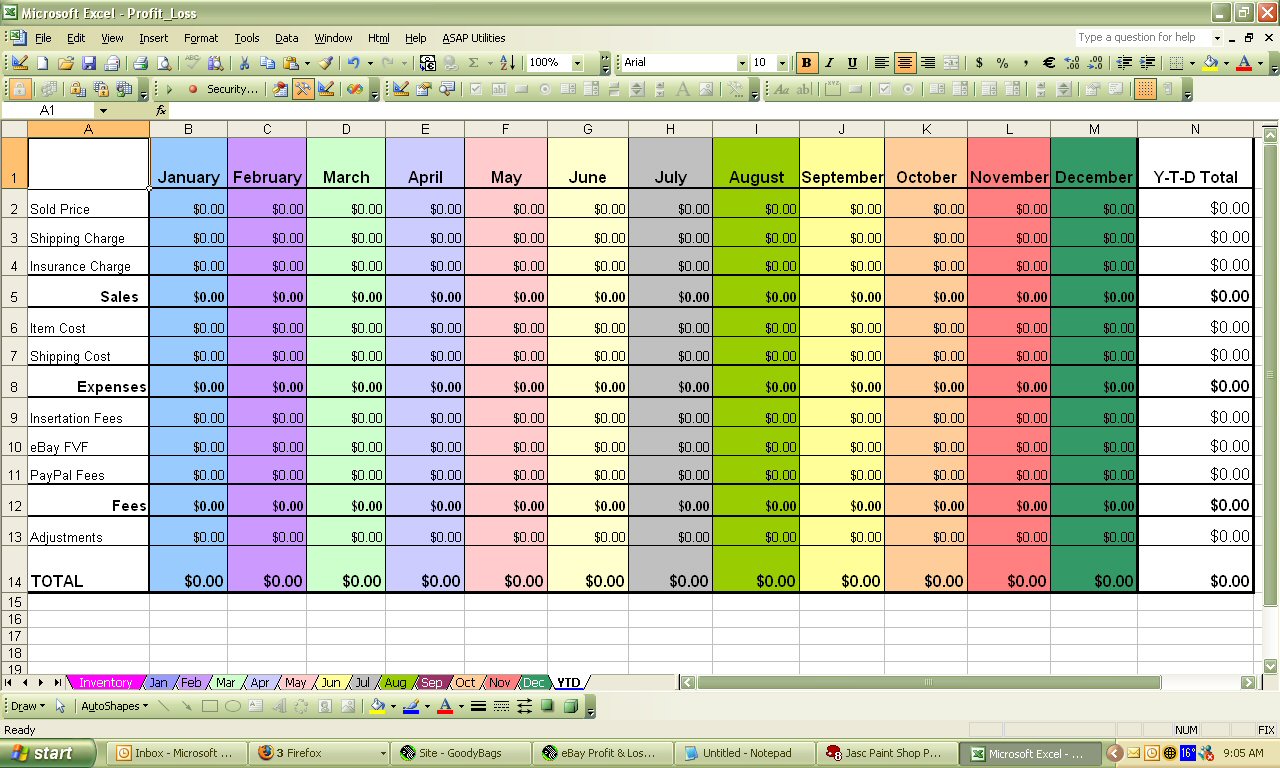

Additionally, you can enjoy an integrated experience with other Microsoft Office suite applications. Excel works flawlessly with products in the Office family, meaning that you can always export or import data with ease. You can use data from Excel in a PowerPoint presentation, or import a chart from Excel into Word to illustrate statistics better. Note that Office 365 is licensed on a subscription basis but it includes the desktop versions, so you don't need a continuous internet connection and you do not need to host your data with Microsoft (i.e. You can use the normal desktop version of Excel with files on your local computer etc).

The OR function returns TRUE if any of its arguments evaluate to TRUE, and returns FALSE if all of its arguments evaluate to FALSE. One common use for the OR function is to expand the usefulness of other functions that perform logical tests. For example, the IF function performs a logical test and then returns one value if the test evaluates to TRUE and another value if the test evaluates to. Now available here.

'We've certainly seen a lot of people try,' said Steve Hankin, CEO of Sentient Flight Group in Weymouth, Mass. Control print screen. 'There are more people who thought they'd be able to do it and didn't than people who have been successful at it.'

David Rimmer, executive vice president of Ronkonkoma, N.Y.-based airplane management company Excelaire, agreed. 'It's hard to achieve, and I think it's not a goal I would go into aircraft ownership with,' he said.

Others, including Cyrus Sigari, president of the recently formed very light jet management company Jetaviva, took a more positive slant. 'If the owner is flying 100 hours or less [per year] and the operator has good scheduling control and can utilize the asset, it's very possible for it to get close to breaking even or even making some money.'

Many expenses require evaluation before you can calculate whether you're flying for free or at greatly diminished cost, however. Along with the fixed and variable costs of operating the aircraft, you must account for acquisition costs as well as tax depreciation and any real depreciation. Tax depreciation in particular is 'a big part of the puzzle,' said Sigari.

But while tax situations and aircraft depreciation vary widely and play crucial roles in determining whether you can achieve zero-net-cost flying, our experts agreed that you must follow certain ground rules to even have a shot at covering your ownership costs with charter revenue. Here's what you must do:

1. Find the right management. 'Your revenue stream is only as good as the company that charters your aircraft,' said Kenneth Starnes, CEO of Woodstock, Ga.-based Cerulean Jet. If a company is aggressively marketing your aircraft to its clients, [covering all your costs] is certainly achievable.'

Rimmer agreed. 'You're depending on the business that your charter company has,' he said. 'You want to make sure that it has the demand to keep your airplane as busy as you want it to be.'

2. Say goodbye to easy access. To maximize charter revenue, you've got to make your aircraft available for customers as much as possible, which can be tough. New owners 'don't always want their shiny airplane to be in the hands of strangers,' said Rimmer. And the times when demand for charter is highest may also be the times when you most want to use the aircraft yourself. Considering how rarely the aircraft might be available to you, said Hankin, 'you have the question of, 'Are you better off just being a charter client yourself?'

Michael Leeds, president of the Long Island, N.Y.-based jet management company FlightStar, commented similarly. 'If you fly the plane 200 hours a year and keep it out of the charter market, you won't get nearly the economic value that you could if you fly 25 hours a year,' he said. Another factor is that your own use boosts costs; the less you fly the aircraft, the less charter income you need to break even.

Scheduling flexibility is crucial. 'It is impossible for you to demand the airplane for 20 days a month' and still come out ahead, Starnes said. 'The charter company needs to be able to get that aircraft when it needs it, and it needs to be available at least 75 percent of the time' to make profitability possible.

Some owners rely on flexibility in their own schedules to achieve greater availability. 'If you insist that you go home New Year's Day, you're cutting out a day when the charter outfit will probably have the ability to get even more business than usual at a higher rate,' Leeds explained. 'What I do all the time is say, 'OK, I'll go the day before or the day after or later in the day to accommodate customers.'

Some owners take the opposite strategy, setting out their usage needs months in advance, according to Bob Seidel, senior vice president and general manager of aircraft management and charter for Jet Aviation. 'Our best arrangements are what we call 'look and book.' The owner's flight schedule is clearly defined, and if the airplane is not down for maintenance and not flying for him, we can make it available for charter,' he said. 'We don't have to go back to the owner and ask for permission.'

3. Go where the action is. 'Does it help to be in a geographic area that's got a population with higher net worth? Absolutely!' said Jetaviva's Sigari, whose outfit is based at Van Nuys Airport in Los Angeles. 'There are quite a few affluent individuals around our area, which makes it a lot easier for us to generate revenue with our airplanes.'

Seidel agreed. 'An airplane is more likely to be chartered if it's where people who want to charter are located or want to go,' he said, adding, 'Say you have the best airplane in the world. If it's in Kansas and all the charter for it is on the coasts, then every time you chartered that airplane, you'd have to fly it to the coast before you even begin the charter and then at the end you'd have to fly it back to Kansas.'

4. Choose a profitable airplane. A lot of the potential profitability in a charter situation depends on the aircraft itself. With the recent spike in fuel costs, newer, more efficient aircraft have a decided advantage. 'For all aircraft, there comes a time when they become less efficient and less desirable,' Leeds said. For some older business jets that time has come.

Recalled Excelaire's Rimmer: 'We had a conversation just the other day with the owner of a [Gulfstream] GII who was surprised to hear that with the operating costs, he might actually lose money chartering out the airplane.' In addition to higher fuel costs, owners of older aircraft face a catch-22 situation: 'I think it's harder with older aircraft, because the more you fly them, the more they need maintenance,' said Hankin.

There is also a customer preference for newer aircraft. 'The newer the model, the better chance it has of being competitive out in the charter market,' Starnes said.

Another factor is how recognizable your aircraft is. 'The more you have to explain an airplane to people, the harder it is to charter,' said Rimmer. 'People like name brands. You don't have to explain a Gulfstream or Global Express.'

5. Sell the right flights. Once your aircraft is chartered, the type of flights for which it is selected can contribute to the bottom line. 'The most advantageous flights in terms of the maximum efficiency of the aircraft and thus the lowest operating costs are long-range trips where you burn all the fuel,' said Jet Aviation's Seidel. 'You're not tankering a lot of fuel at the end of the day from point A to point B and you're able to fly at very high altitudes.'

Owners should monitor how charter operators use their aircraft, Rimmer said. 'The reality is that every charter management company has to service its clients by doing both the better trips and the less productive trips,' he explained. 'You just want to keep an eye on how many of those good trips your airplane's getting and be realistic about whether good trips are a reasonable expectation in your airplane.'

Additionally, you can enjoy an integrated experience with other Microsoft Office suite applications. Excel works flawlessly with products in the Office family, meaning that you can always export or import data with ease. You can use data from Excel in a PowerPoint presentation, or import a chart from Excel into Word to illustrate statistics better. Note that Office 365 is licensed on a subscription basis but it includes the desktop versions, so you don't need a continuous internet connection and you do not need to host your data with Microsoft (i.e. You can use the normal desktop version of Excel with files on your local computer etc).

The OR function returns TRUE if any of its arguments evaluate to TRUE, and returns FALSE if all of its arguments evaluate to FALSE. One common use for the OR function is to expand the usefulness of other functions that perform logical tests. For example, the IF function performs a logical test and then returns one value if the test evaluates to TRUE and another value if the test evaluates to. Now available here.

Can You Buy Microsoft Excel

The first is to buy a subscription to Office 365 which lets you use the latest full versions of Word, Excel, Powerpoint and Outlook on your PC as well as on any tablets or smartphones you own. Shop for microsoft excel at Best Buy. Find low everyday prices and buy online for delivery or in-store pick-up. Love the botton on it so you can go back to your previouse page, the scroll ball in quiet so you wont wake anyone up. However, this should not be an option, it should have been included with the Surface Pro itself.